Wealth Management 2020 – company culture of banks hardly enable new creative methods and innovations

07. October 2015

“Death of banks by a thousand stitches: FinTechs focus on small sectors of the banks and attack there”, with this, André M. Bajorat, host of the Paymentandbanking.com blog, together with Boris Janek from Finance ZweiNull opened the first FinTech conference of the FintechStars. This years conference focused on Wealth Management in 2020, for which etventure daughter- company FintechStars and the Berlin School of Digital Business invited to, last Thursday (01. Oktober 2015).

Changes in customer-demand on banks in the area of wealth management: BSDB Dr. Birte Gall and Gregor Puchalla invite to a Fin-slam and therefore create a platform for an open dialogue between FinTechs and banks

The financial markets are undergoing radical changes currently. Foreigners in the sector, digital players and startups are entering the market and attack traditional enterprises in their expertise and business models. This first FinTech conference by FintechStars and the Berlin school of Digital Business, offered banks and FinTechs a platform for constructive dialogue and exchange under the theme of wealth management.

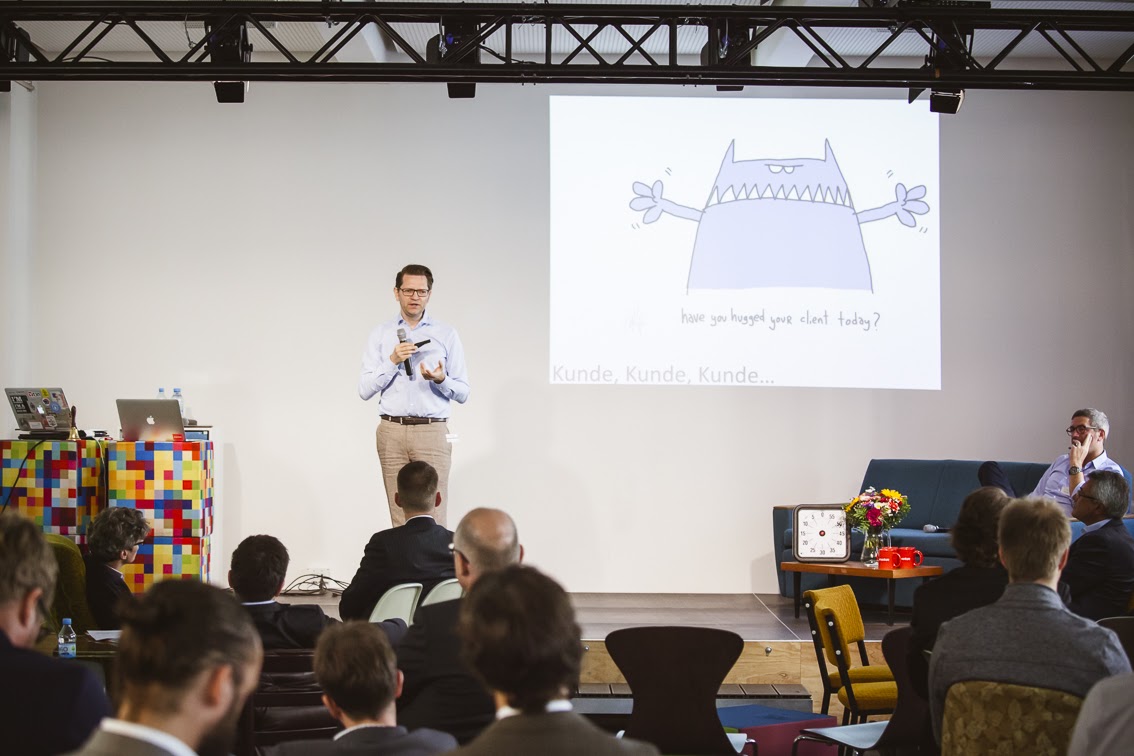

“Have you hugged your client today?” – Together with André Bajorat, Brosi Janek elaborates why customers should be at the center of product development and how this is made possible – fast and cheap

In the “Fin-slam”, banks such as UBS Consorbank and HypoVereinsbank as well as FinTechs like quirion, vaamo and wikifolio initially faced off against each other. In 5 minute pitches, they presented just how well their digital solution covers the demands of their digital customer base. The auditorium primarily consisted of managers and board members of the representing banks; from Augsburger Aktienbank over to Comdirect and Deutsche Bank and Wüstenrot Bank, rated the presentations after how well they already satisfy the digital demands of their clientel. FinTech- as well as bank representatives voted for FinTech firms to take the first three places with distinctive detachment. Wikifolio made it to first place.

Birte Gall, CEO of the Berlin School of Digital Business: “Our idea, enganging FinTechs and banks in a constructive dialogue was a success. The Fin-slam clearly highlighted the current state of the art in the digital financial sector. And in the following Design Thinking workshop, representatives from both sites developed new ideas and concepts. ”

FinTechs and banks worked well together in the Design Think workshop to produce prototypes for wealth management solutions – here the Dataglasses for a scenario simulation model.

Banks are underestimating the risk for their core business

Nevertheless – The financial industry has lost a lot of customer trust and is running a large risk through disruption. The new competition successfully wins digital customers due to their change in demand and the innovative business models offered by the FinTechs to satisfy these. This has caused a large need for digitalization in the banking industry. Although these young customers, due to their low capital, do not yet target audience for private banking, a lot of banks are underestimating the risk of these young investors never leaving their social trading and algorithm advising platforms.

Gregor Puchalla, CEO of FintechStars: “Banks are facing a huge challenge. Their company culture and rigid guidelines do not provide the nurturing ground for innovative projects, business models and creative methods to grow. A change in culture seems to be necessary. Cooperations with FinTechs could be profitable for both: Banks bring funds and customers to the table, while FinTechs bring fresh thinking approaches and methods with them to help implement innovative ideas quickly.”

* Required field