Berlin, 30 January 2017 – The German banking industry has recognised the importance of digital transformation. But financial institutions are still finding it difficult to implement. This is the finding of the benchmark study “Digital transformation of banks”, which was carried out by FinTechCube, a joint venture under the umbrella of etventure, in collaboration with Prof. Julian Kawohl from HTW Berlin – University of Applied Sciences. The study asked decision makers at more than 30 banks and around 200 private clients about what they wanted from modern digital banking.

Transformation founders on internal resistance

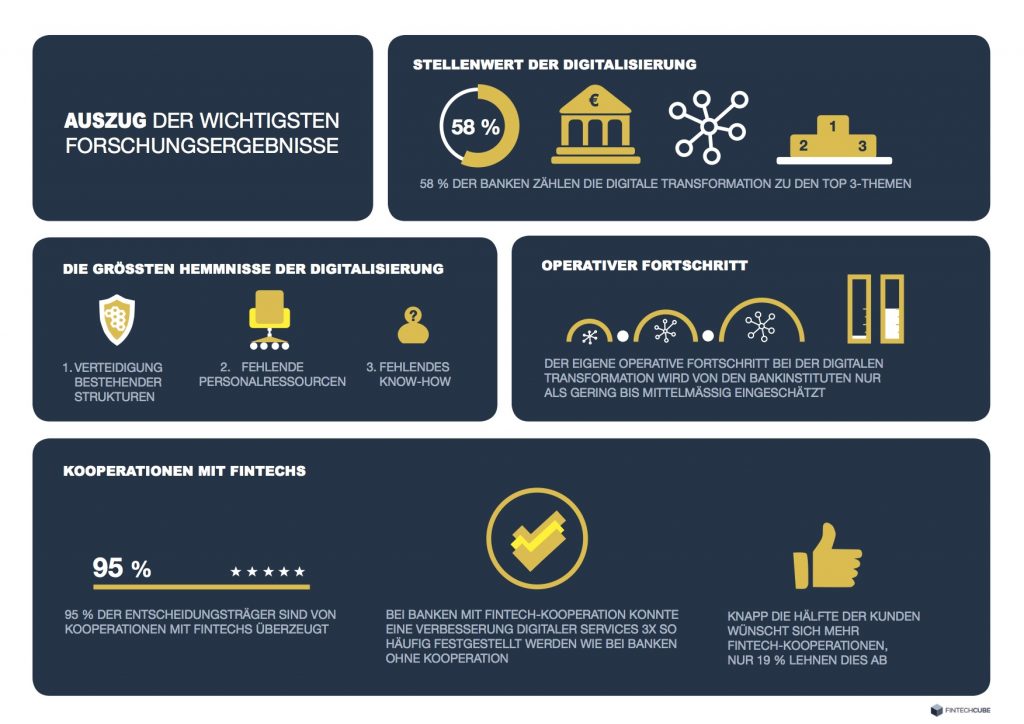

Digital transformation was one of the top three corporate issues for 58 per cent of banking institutions surveyed. Less than 10 per cent think that digitisation plays no or only a secondary role for their company. This is also reflected in their budgets. Around 90 per cent of banks increased their budgets for digitisation and innovation processes in 2016 compared to the previous year, and 71 per cent are planning to further increase the budget for the next 12 months.

But even if the majority of banks now recognise the importance of digital transformation for the future success of their organisation, they are stumbling over the implementation. Thus, the decision makers surveyed assess the progress achieved to date as only low to moderate in most areas. The main reason for this is internal resistance. The most frequently mentioned hurdle to digital transformation is “defending existing structures” in companies, followed by a lack of personnel resources and insufficient expertise.

Cooperation with fintechs improves digital services long term

Many banking institutions see their cooperation with fintechs (start-ups that focus on financial technologies) as a means to achieve faster and more successful digitisation. 95 per cent of decision makers surveyed are convinced of the advantages of collaboration, and 60 per cent of banks are already working with digital players – with measurable success. Thus, a significant improvement in digital services was found almost three times as frequently at banks with fintech collaborations compared to banks without a start-up partnership.

The need to digitise is also confirmed by customers. One in two private customers would like their bank to collaborate more closely with fintechs. In both the group of “millennials” or “digital natives” and the 31-50 age group, around 60 per cent support a cooperation of this kind. However, the survey also shows a significant discrepancy between customer requirements and the banks’ current offer. While customers want a cooperation with fintechs mainly in the areas of e-commerce, crowdfunding and crowdinvesting, and P2P payment and blockchain, start-up partnerships in these segments have been hard to find so far.

Lack of customer focus and communication

“The majority of financial institutions have taken the first steps towards a modern, digital banking offer. However, what the banks lack is customer focus. That is shown very clearly by the study,” explained Gregor Puchalla, CEO of FinTechCube. “Digital offers are often developed in areas of secondary importance for customers. A significant reason for this is the lack of interaction between banks and customers. For example, 63 per cent of the private customers surveyed by us didn’t know whether their bank was pursuing any cooperation with fintechs. This means that banks are also missing out on a significant marketing advantage. Because the majority of customers who know about their bank’s digital projects perceive it to be more advanced. Accordingly, banks should develop the interaction with their customers, obtain feedback and actively market their start-up collaborations.30